Best Budgeting Apps To Boost Your Bank Account

Considering the best budgeting apps to use could help you with your financial needs. The U.S. Federal Reserve estimates that about half of adults in the U.S. could not afford a 400 dollar emergency. To cover that sudden expense, they would need to borrow money or sell something they own. The good news is you can manage your money right on your phone. Find out more about these awesome apps here.

Best Budgeting Apps You Should Try

In this article:

Getting Your Information Together

A good place to start is to look for the best budgeting apps to watch your bank accounts. There are several that do this well without costing you any money.

One of the best budgeting apps for iPhone and Android users is Mint. It creates a list of your accounts like savings, checking, and even credit cards. With everything together in one place, you have better control over your money.

PocketGuard does the same thing as Mint but also figures out a budget for you by looking at how much you spend. Like Mint, it lets you set limits on how much you want to spend for things like groceries. It also lets you know if you go over. Both Mint and Pocketguard are available for iOS and Android.

Spendee is another budgeting and account monitoring app for the whole family. The app is free to use but does offer a subscription service if you want more features.

Mvelopes

https://www.instagram.com/p/BfyttOrAnWv/

Mvelopes does the budgeting for you based on your income. It also looks at how you spend to find hidden fees and gets rid of them while tracking your credit cards at the same time. This money app is good for all income levels but it is not free like the other apps. You can use Mvelopes for a short time for free but, eventually, will end up paying for the service. They offer different subscription levels from Basic, going all the way up to Budget Makeover. It’s a 10-week program to get you back on the savings track.

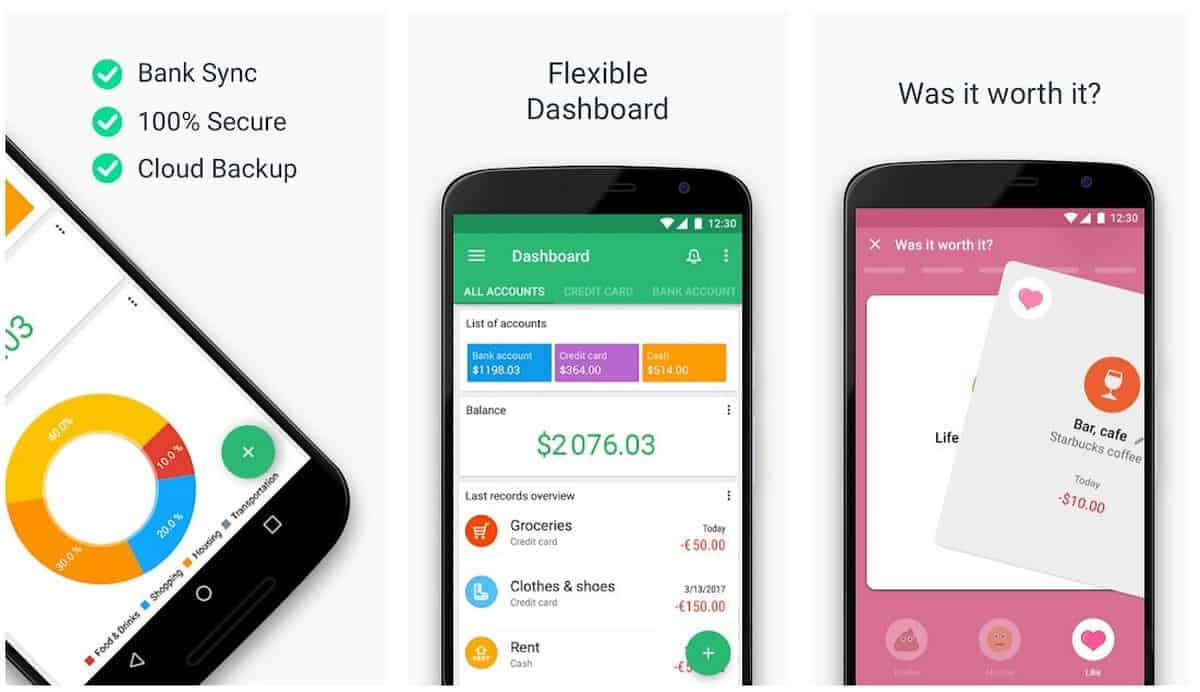

Budget Bakers (Wallet)

If you want to take a different approach to developing your savings, then Acorns is the right money app for you. It doesn’t help you make a budget or track your bank accounts for you. It takes money out of your accounts pennies at a time to save for a rainy day by rounding up. If you spend 10.05 dollars at the store, it will round up your spending to 11 dollars. It will then deposit 95 cents into a savings account.

You decide what accounts you want Acorns to monitor and take money from. Now, stand back and watch your savings grow. It is an easy way to build up an emergency fund if saving money on your own is hard. Acorns invests the money you save, too, so it grows.

Stash

https://www.instagram.com/p/BcS_GiQjv4x/

Stash works like Acorns because it moves small amounts of money automatically. You can save just five dollars a week using your Stash account and they invest that money for you. It’s a good choice for those who can’t afford to save much but want to put aside just a little each week.

Watch this video about saving money using some of the best budgeting apps available right now.

Saving money doesn’t have to be hard work. Just use your phone and a budgeting app to track what you spend and let the savings grow.